The second part of the summer transfer window has reopened again – and there is still more business to be done before it closes on September 1.

Few knew what to expect from the special window brought in ahead of the Club World Cup – but it delivered 10 days of transfer drama and has now set the tone for what promises to be a fascinating summer.

Manchester City were the big spenders after doing their business early by bringing in Tijjani Reijnders, Rayan Cherki, Rayan Ait Nouri and Marcus Bettinelli – taking their outlay to £116.2m.

Despite three of City’s signings being announced on the first window’s Deadline Day, it was Chelsea, the other Premier League team at the Club World Cup, that were centre of attention once again as they chased potential late deals for Jamie Gittens and Mike Maignan.

Chelsea ended their pursuit of AC Milan goalkeeper Maignan and ran out of time to conclude a deal for Dortmund forward Gittens.

Chelsea were happy to wait as they do not want to overpay for Gittens and plan to revisit the deal further down the line. Gittens, who wants to move to Chelsea, appeared frustrated as he left Dortmund’s training ground as Deadline Day drew to a close.

Dortmund were able to get an incoming deal over the line ahead of the tournament as they signed Jobe Bellingham from Sunderland in a club-record sale for the newly promoted Premier League club, who are receiving an initial £27.8m for the 19-year-old.

Other deals were announced in between windows, with Mathys Tel completing a £30m permanent move to Spurs and Leeds signing Lukas Nmecha from Wolfsburg on an initial two-year deal.

First summer window in numbers

Sky Sports Data Editor Adam Smith:

Premier League clubs splashed nearly £500m after only 10 days of the first summer window, which is already close to half the amount spent during the entire 2021/22 summer window.

City were the most spendthrift club as Pep Guardiola’s side looked to rebuild after a disappointing campaign, having spent a table-topping £116.3m so far.

At the other end of the scale, Wolves are nearly £100m in profit after selling star players Matheus Cunha and Rayan Ait Nouri.

Burnley and Chelsea lead the way for total incomings, with both sides signing four players on permanent deals. Only seven sides have yet to secure a signing.

Arsenal offloaded 17 players, while Wolves (13), Burnley and Spurs (both 10) also trimmed their squads considerably.

Cunha’s £62.5m switch to United has been the most expensive deal in the window so far, followed by Tijjani Reijnders (£46.3m), Rayan Ait Nouri (£36m), Jean-Clair Todibo (£35m) and Rayan Cherki (£34m).

In terms of outgoings, Bournemouth cashed in £50m from selling Dean Huijsen to Real Madrid, while Sunderland sold Jobe Bellingham to Dortmund for £32m and City also sold Yan Couto to the Bundesliga club for £25m.

Chelsea sign a striker – but Arsenal still searching for one

Chelsea bolstered their frontline ahead of the Club World Cup with the £30m arrival of Liam Delap from Ipswich.

The 22-year-old was one of three signings along with Mamadou Sarr and Dario Essugo, who have been recruited in time to play in the US. Estevao Willian will join from Palmeiras after the tournament – and he could face Chelsea there while turning out for the Brazilian side.

Arsenal target Benjamin Sesko emerged as an option for Saudi Pro-League club Al Hilal as they scrambled to make a marquee signing in time for the Club World Cup, but the RB Leipzig striker’s preference to play for a top club in Europe amid talks with Arsenal appeared to stop Al Hilal from taking their interest any further on Deadline Day.

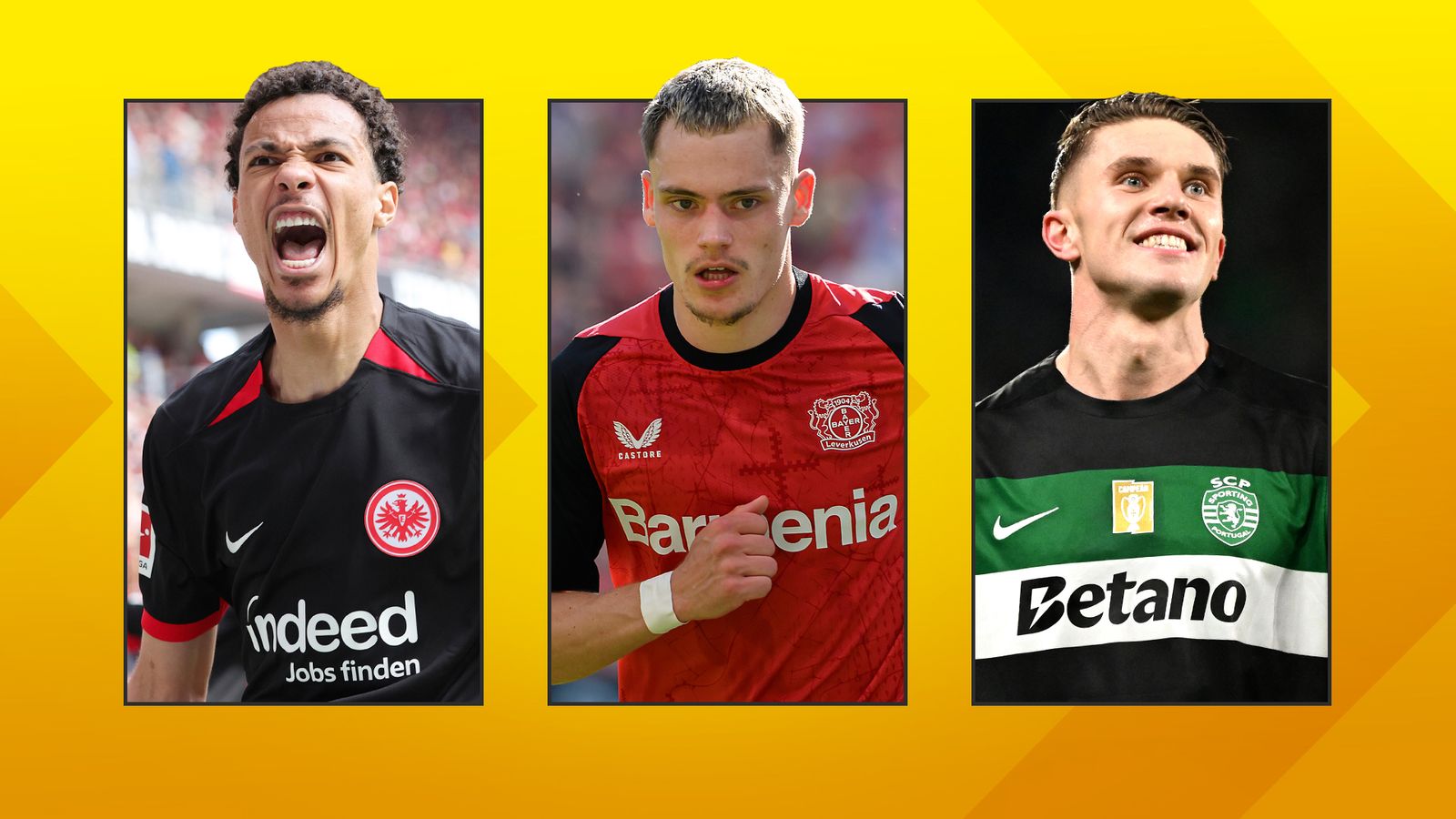

Sesko will be one of the names to watch for the rest of the summer, with Arsenal seemingly prioritising a move for the 22-year-old ahead of Sporting Lisbon’s Viktor Gyokeres in their hunt for a striker. Adding a left winger is another priority, with Real’s Rodrygo among the list of targets. At the other end of the pitch, Arsenal are progressing with a deal to sign Chelsea goalkeeper Kepa Arrizabalaga and are expected to trigger the Spaniard’s £5m release clause.

Liverpool agree club-record signing, with more arrivals on the way

The Gunners have taken a backseat in the early running of the window, though, with Premier League champions Liverpool now agreeing a British-record transfer fee of £116.5m to sign Florian Wirtz from Bayer Leverkusen after the Germany playmaker turned down a move to Bayern Munich.

The Reds have, though, lost key player Trent Alexander-Arnold to Real for £10m and goalkeeper Caoimhin Kelleher to Brentford in an £18m deal.

But Liverpool, who have goalkeeper Giorgi Mamardashvili joining from Valencia, have already signed a right-sided player following Alexander-Arnold’s exit, with the £29.5m arrival of Jeremie Frimpong.

At left-back, Liverpool have made initial contact for Bournemouth defender Milos Kerkez.

Meanwhile, Atletico Madrid are interested in signing Andy Robertson.

Luis Diaz raised doubts about his future when he revealed he was in talks with other clubs while away with Colombia after the Merseyside club rejected an approach from Barcelona.

Diaz is one of two targets Barca have for the forward position, along with United’s Marcus Rashford, whose future appears certain to be away from Old Trafford. Interest is expected in the 27-year-old, who will cost £40m this summer.

Man Utd make most expensive signing so far

United were unusually quick out of the blocks with their business after signing Cunha from Wolves for £62.5m – the most expensive signing of the summer so far.

Ruben Amorim’s side are already eyeing their second summer signing with an approach for Brentford forward Bryan Mbeumo. The Bees have turned down their opening £55m bid, though talks are continuing and United are expected to return with an improved offer for the Cameroon forward, valued at more than £60m.

However, Tottenham have now held initial discussions with Brentford about a deal for Mbeumo, who is more intrigued in a Spurs move now that Thomas Frank has been appointed head coach, although the player is still understood to be leaning towards United, who are expected to go back in with a fresh offer for the for the 25-year-old.

Once that pursuit has concluded, the plan is to try and sign a striker. Gyokeres is one of their targets up front and approaches have been made for the Sporting frontman through intermediaries, although recent reports in Portugal claim the player would prefer a move to Arsenal.

United have also entered the race for Eintracht Frankfurt striker Hugo Ekitike – who is also interesting Liverpool and Chelsea – according to Sky in Germany. However, it will likely take a few sales to facilitate any further signings after the potential arrival of Mbeumo.

Rashford, Alejandro Garnacho and Antony are among those who could go with plenty of interest anticipated. Rasmus Hojlund is a target for Inter Milan, but has said he expects to remain at United despite the club being linked to other strikers.

United’s Europa League final conquerors, Tottenham, are yet to make a fresh addition to their squad having appointed Thomas Frank to replace the sacked Ange Postecoglou. But Spurs have stepped up their interest in Bournemouth forward Antoine Semenyo, valued at £70m by the south-coast club.

Expect things to really ramp up when the transfer window re-opens for business on Monday, before slamming shut on September 1 at 7pm.